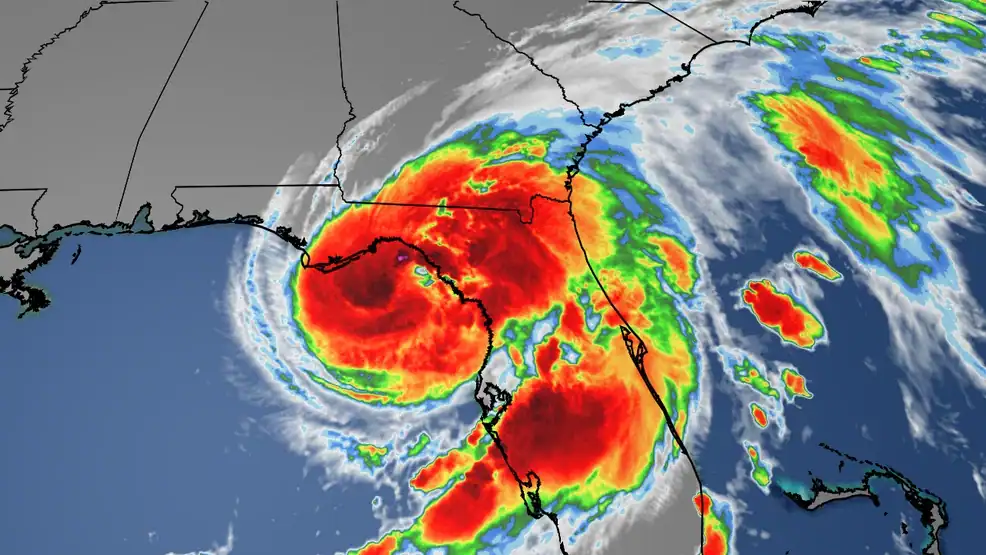

Florida’s sun-soaked beaches and vibrant communities come with a significant challenge: hurricanes. As the most hurricane-prone state in the U.S., Florida faces frequent storms that threaten property and financial stability for Homeowners Associations (HOAs) and condominium associations. Reserve studies—essential planning tools for budgeting repairs and replacements of common property elements like roofs, windows, and structural components—must account for these climate-driven risks. This article explores how hurricanes impact reserve study planning in Florida, offering insights into legal requirements, practical strategies, and best practices to ensure HOAs remain financially prepared for storm-related challenges.

What Are Reserve Studies?

A reserve study is a financial roadmap for HOAs, combining a physical analysis of common area components (e.g., roofs, pools, elevators) with a funding plan to cover future repairs or replacements over a 30-year horizon. By forecasting costs and establishing reserve funds, these studies prevent unexpected special assessments and ensure equitable contributions from residents. In Florida, where hurricanes can accelerate wear and tear on buildings, reserve studies are critical to maintaining community infrastructure and financial health.

The Impact of Hurricanes on Property Maintenance

Hurricanes bring high winds, storm surges, and heavy rainfall, causing structural damage, roof leaks, window failures, and flooding. These events shorten the lifespan of key components, requiring more frequent maintenance or earlier replacements. For example, a roof expected to last 20 years might need replacement after a Category 4 hurricane due to wind damage. Exterior walls, siding, and windows are also vulnerable, often requiring repairs to prevent water infiltration or mold growth.

Post-hurricane repairs can strain HOA budgets, especially if insurance claims are delayed or insufficient. The increased frequency of hurricanes—averaging one landfall every three years in Florida, per the Florida Climate Center—demands that reserve studies include higher allocations for maintenance and contingency funds to address unexpected damages.

Legal Requirements: Senate Bill 4-D

Florida’s Senate Bill 4-D, enacted in May 2022, mandates structural integrity reserve studies for condominiums and cooperatives with buildings three stories or higher, with the first study due by December 31, 2024 Florida Senate Bill 4-D. This law, spurred by the 2021 Surfside collapse, requires inspections by licensed engineers or architects to assess load-bearing walls, foundations, and other critical elements. Associations must fully fund reserves for these components, eliminating the option to waive contributions.

This legislation underscores the need for hurricane-resilient planning, as structural integrity is vital for withstanding storm forces. HOAs must integrate these requirements into their reserve studies, ensuring compliance and adequate funding for hurricane-related repairs.

Incorporating Hurricane Risks into Reserve Studies

Effective reserve studies in Florida must address several hurricane-specific factors:

- Insurance Deductibles: Hurricane insurance policies often carry high deductibles, sometimes $100,000 or more Reserve Study FL. Reserve funds should cover these costs to avoid special assessments post-storm.

- Contingency Funds: Uninsured damages, such as landscaping or minor repairs, require contingency reserves to maintain financial stability.

- Adjusted Component Lifespans: Components like roofs and windows may need earlier replacements due to hurricane exposure, increasing reserve contributions.

- Frequent Updates: While the Community Associations Institute (CAI) recommends updates every 3-5 years, post-hurricane assessments are essential to reflect new damages.

Case Studies: Real-World Impacts

Hurricane Irma in 2017 devastated the Florida Keys, destroying 25% of homes and damaging 65% extensively Internet Geography. An HOA in Key West faced significant reserve fund depletion after repairing roofs and windows, highlighting the need for robust planning. Similarly, a Miami condo association post-Hurricane Andrew (1992) struggled with a $150,000 insurance deductible, underscoring the importance of reserving for such costs.

Best Practices for HOAs

To mitigate hurricane risks, Florida HOAs should adopt these strategies:

- Hurricane-Resistant Upgrades: Invest in impact windows, reinforced roofs, and storm shutters to reduce damage and lower insurance premiums Insurance Business America.

- Professional Expertise: Partner with reserve study firms like Expert Reserve Services to ensure compliance with SB 4-D and accurate risk assessments.

- Comprehensive Insurance: Maintain policies covering hurricane damage, understanding deductibles and exclusions Florida CFO.

- Community Engagement: Educate residents on hurricane preparedness through workshops and newsletters, encouraging personal storm plans and transparency on reserve funding needs ([Internal Link: /hurricane-preparedness-guide]).

- Post-Storm Assessments: Conduct immediate inspections after hurricanes to update reserve studies and adjust funding plans.

Climate Change and Future Risks

Climate change intensifies hurricane risks, with warmer seas fueling stronger, wetter storms Center for Climate and Energy Solutions. Sea level rise, projected at 1-2.5 feet by 2100, increases coastal flooding risks for Florida’s HOAs. Rising insurance costs, up 40% since 2017 in some areas, further strain budgets Natural Hazards Center. HOAs should explore adaptation measures, like elevating structures or installing flood barriers, and increase reserve contributions to address these long-term challenges.

Conclusion

Hurricanes pose significant challenges to reserve study planning in Florida, demanding higher maintenance budgets, compliance with laws like Senate Bill 4-D, and proactive risk management. By investing in resilient upgrades, maintaining robust insurance, engaging residents, and updating studies regularly, HOAs can safeguard their communities against storm impacts. As climate change escalates risks, forward-thinking planning is essential for financial stability and resident safety.