Homeowners Associations (HOAs) face unique financial challenges, from maintaining community amenities toensuring long-term property value. Effective financial planning is essential to avoid unexpected costs and keepresidents satisfied. At the heart of this process lies the reserve study—a powerful tool that helps HOAs budgetfor future repairs and replacements. This guide explores how reserve studies drive financial planning for HOAs,offering strategies to achieve stability and transparency. For professional support, explore our reserve studyservices ([YOUR-SITE]/reserve-study-services).

What Is a Reserve Study?

A reserve study is a comprehensive financial plan that evaluates an HOA’s common area components (e.g., roofs, pools, sidewalks) and estimates the funds needed for their repair or replacement over a 30-year period. It includes two parts: a physical analysis, assessing component condition and remaining useful life, and a financial analysis, calculating reserve contributions. According to the Community Associations Institute (CAI) reserve studies help HOAs avoid special assessments and maintain fiscal health.

Why Reserve Studies Matter for HOAs

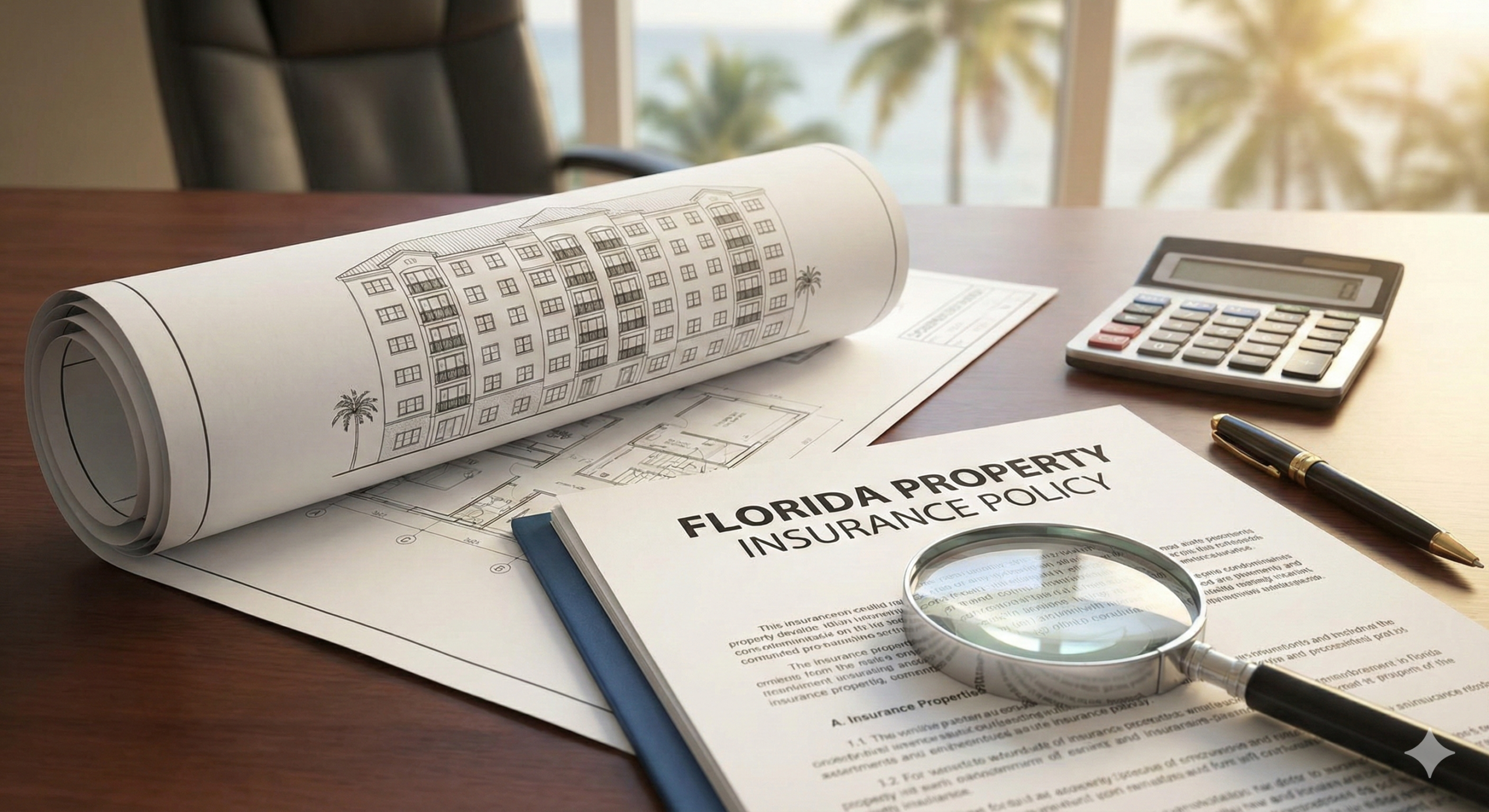

Without a reserve study, HOAs risk underfunding repairs, leading to special assessments that burden residents. For example, a failing roof costing $100,000 could force a $5,000 assessment per unit in a 20-unit community if reserves are inadequate. Reserve studies provide predictability, ensuring funds are available when needed. They also enhance transparency, reassuring residents that their fees are managed responsibly. In states like Florida, laws like Senate Bill 4-D mandate reserve studies for structural components, making them legally essential.

What Is the Purpose of a Reserve Study?

The purpose of a reserve study is to provide HOAs and condo associations with a comprehensive financial plan for maintaining and replacing common area components, such as roofs, pools, and sidewalks, over a 30-year period. By assessing current conditions and estimating future costs, it ensures adequate funds are reserved to avoid financial distress, special assessments, and non-compliance with laws like Florida’s Senate Bill 4-D.fpat.com

Key Objectives of a Reserve Study

- Predictable Budgeting: Forecast long-term expenses to maintain consistent dues and prevent sudden increases.

- Risk Mitigation: Reduce the need for loans or special assessments during emergencies by ensuring reserves are funded.

- Property Value Protection: Keep community amenities well-maintained to attract buyers and preserve values.

- Legal Compliance: Meet Florida requirements, such as Senate Bill 4-D, to avoid penalties and ensure structural integrity.

- Transparency for Residents: Provide clear financial planning that builds trust and reduces disputes over fees.

Benefits of a Reserve Study for Florida HOAs

| Benefit | Description | Example Impact |

|---|---|---|

| Predictable Budgeting | Forecasts expenses for consistent dues. | Avoids sudden fee hikes; HOAs with studies are 60% less likely to face distress (CAI 2023 report). |

| Risk Mitigation | Ensures funds for repairs, reducing loans or assessments. | Prevents $5,000 per-unit assessments for a $100,000 roof failure in a 20-unit community. |

| Property Value Protection | Maintains amenities to attract buyers. | Enhances community appeal and long-term value. |

| Legal Compliance | Meets Senate Bill 4-D mandates. | Avoids penalties for structural components in Florida condos. |

| Transparency | Builds resident trust in fee management. | Reduces financial disputes and improves HOA governance. |

Key Components of a Reserve Study

A well-executed reserve study includes:

- Component Inventory: Lists all common elements (e.g., elevators, HVAC systems) requiring maintenance.

- Condition Assessment: Evaluates each component’s current state and remaining useful life.

- Cost Estimates: Projects replacement costs, adjusted for inflation, based on industry data.

- Funding Plan: Recommends annual reserve contributions to meet future expenses, often using methods like cash flow or component funding.

These elements ensure HOAs have a clear financial roadmap tailored to their community’s needs.

How Reserve Studies Enhance Financial Planning

Reserve studies offer several benefits for HOA financial planning:

- Predictable Budgeting: By forecasting expenses, HOAs can set consistent dues, avoiding sudden increases.

- Risk Mitigation: Adequate reserves reduce the need for loans or assessments during emergencies.

- Property Value Protection: Well-maintained communities attract buyers, boosting property values.

- Legal Compliance: In Florida, reserve studies meet requirements like SB 4-D, protecting HOAs from penalties.

A 2023 CAI report notes that HOAs with reserve studies are 60% less likely to face financial distress, underscoring their value.

Challenges in Reserve Study Planning

Best Practices for HOAs

HOAs may face challenges when implementing reserve studies:

- Resistance to Dues Increases: Residents may oppose higher fees to fund reserves. Solution: Educate them on long-term savings.

- Inaccurate Assessments: Poorly conducted studies can misestimate costs. Solution: Hire experienced firms like FPAT Reserve Services

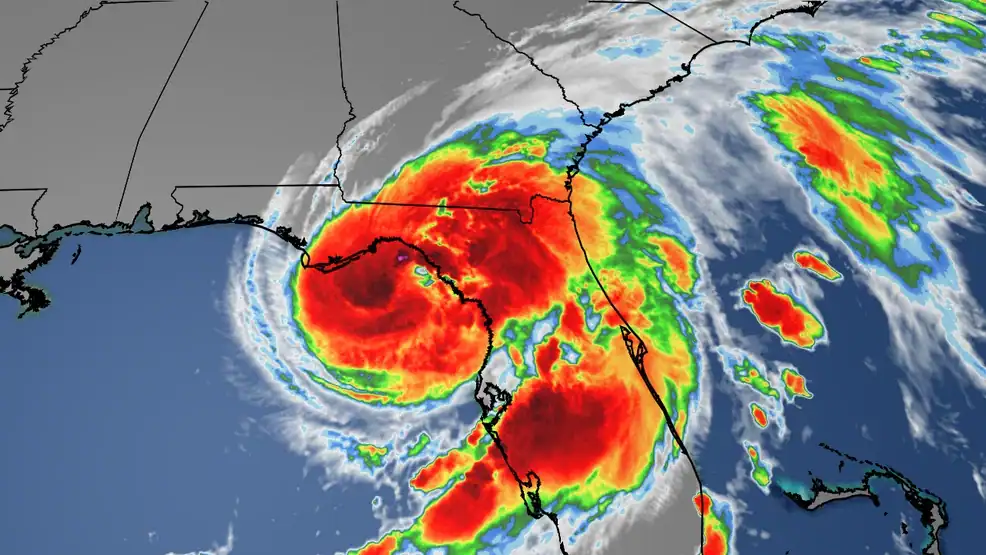

- Insurance Gaps: High deductibles can strain reserves

- Solution: Include deductibles in reserve planning.

To maximize reserve study benefits, HOAs should:

- Hire Professionals: Work with certified reserve specialists for accurate assessments.

- Update Regularly: Review studies every 3-5 years or after major events like hurricanes.

- Engage Residents: Share reserve study findings to build trust. Explore our hurricane preparedness guide ([YOUR-SITE]/hurricane-preparedness-guide) for community tips.

- Diversify Funding: Combine reserve contributions with other revenue (e.g., amenity fees) to ease the burden.

Conclusion

Reserve studies are the cornerstone of financial planning for HOAs, providing a roadmap to manage repairs, avoid assessments, and ensure community stability. By addressing challenges, adopting best practices, and staying compliant with laws, HOAs can protect their financial future. Start planning today to safeguard your community’s assets and resident satisfaction.

Download Our Free Reserve Study Guide

Ready to strengthen your HOA’s financial plan? Fill out the form below to receive our free PDF guide, Understanding Reserve Studies, delivered to your inbox.

[WPForms Shortcode: Place [wpforms id=”a8480b7″] here in Elementor’s Shortcode widget]

If the form doesn’t load, please contact us ([YOUR-SITE]/contact) to request the PDF.

[WPForms Shortcode: Place [wpforms id=”a8480b7″] here in Elementor’s Shortcode widget]

If the form doesn’t load, please contact us ([YOUR-SITE]/contact) to request the PDF.

Error: Contact form not found.

References

- Community Associations Institute (https://www.caionline.org/)

- Florida Senate Bill 4-D (https://www.flsenate.gov/Session/Bill/2022D/4D)

- Expert Reserve Services, Inc (https://expertreserveservices.com/)

- Florida CFO: Hurricane Deductibles (https://www.myfloridacfo.com/division/consumers/consumerprotections/floridashurricanedeductible)

- Center for Climate and Energy Solutions (https://www.c2es.org/content/hurricanes-and-climate-change/)