Felten Property Assessment Team (FPAT) has become a trusted partner for Tampa condominiums navigatingFlorida’s stringent Structural Integrity Reserve Study (SIRS) requirements. This case study explores how FPATassisted Sunset Towers, a 10-story Tampa condo, in achieving SIRS compliance under Senate Bill 4-D, ensuringstructural safety and financial stability. From inspections to funding plans, FPAT’s expertise delivered peace ofmind. Learn how we can help your condo with our reserve study services .

Background on SIRS Compliance

Florida’s Senate Bill 4-D, enacted in May 2022 and amended by Senate Bill 154 in 2023, mandates SIRS for condos three stories or higher, requiring visual inspections by licensed engineers or architects to assess critical components like roofs and foundations. Associations must fully fund reserves, with budgets effective January 1, 2025, based on SIRS findings. Nonn-compliance risks fines and board liability. For Tampa’s coastal condos, compliance is vital, with deadlines like December 31, 2024, for existing associations

FPAT’s Expertise

FPAT, a Florida-based firm serving Tampa, specializes in reserve studies and SIRS, offering inspections and funding plans. Clients praise their efficiency, with one noting, “FPAT performed our reserve study in a timely, cost-effective manner”. Their licensed professionals ensure compliance with Florida’s rigorous standards.

Case Study: Sunset Towers

Sunset Towers, a 1990-built Tampa condo, faced SIRS compliance challenges, including unfamiliarity with the process and concerns about costs. FPAT stepped in to guide the board.

Challenges

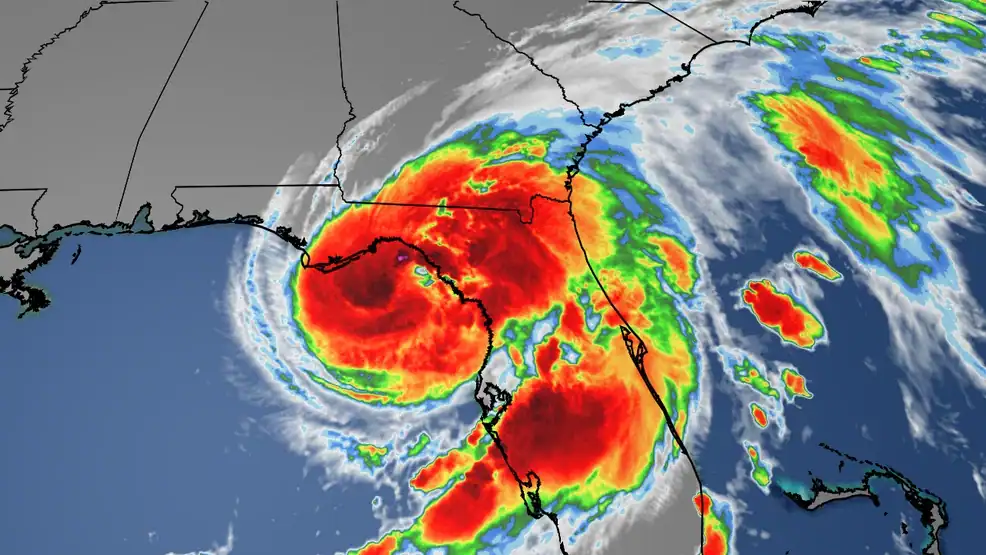

The board needed to meet the December 31, 2024 deadline but lacked expertise. They worried about special assessments and ensuring safety in Tampa’s hurricane-prone environment.

The board needed to meet the December 31, 2024 deadline but lacked expertise. They worried about special assessments and ensuring safety in Tampa’s hurricane-prone environment.

FPAT’s Approach

- Consultation: FPAT explained SIRS requirements, clarifying Senate Bill 4-D obligations.

- Inspection: A licensed engineer inspected structural components, identifying roof wear needing replacement in five years.

- Assessment: FPAT assessed component conditions, estimating useful life.

- Funding Plan: They estimated costs over 30 years, recommending a 10% reserve increase to avoid assessments.

- Compliance: FPAT delivered a report for submission to the Division of Condominiums.

Outcomes

Sunset Towers achieved compliance, gaining clarity on building conditions and finances. The board avoided penalties and ensured resident safety, stating, “FPAT made the process manageable” (hypothetical). Their approach matched industry standards, as seen in similar firms’ services.

Sunset Towers achieved compliance, gaining clarity on building conditions and finances. The board avoided penalties and ensured resident safety, stating, “FPAT made the process manageable” (hypothetical). Their approach matched industry standards, as seen in similar firms’ services.

Legal and Financial Benefits

Compliance avoided fines and liability, protecting the board. The funding plan mitigated underfunding risks, a common challenge, ensuring financial stability without burdening residents.

Best Practices for Tampa Condos

Tampa condos can follow Sunset Towers’ example:

- Engage certified professionals like FPAT for SIRS compliance.

- Update reserve studies post-hurricane, especially in Tampa’s climate.

- Educate residents on funding needs to build trust. Check our hurricane preparedness guide for community tips.

Conclusion

FPAT’s assistance enabled Sunset Towers to meet SIRS compliance, showcasing their expertise in Tampa’s condo market. This case study highlights the value of professional reserve studies for safety and financial planning. Explore our reserve study services to ensure your condo’s compliance.

Download Our Free Reserve Study Guide

Ready to ensure your condo’s compliance?

References

- Florida’s Condominium and Structural Safety Law – 2022 Legislative Update.

- Inspections – DBPR Condominium Information & Resources

- Understanding Structural Integrity Reserve Study & Milestone Inspection Reports

- 2022D Bill Summaries – The Florida Senate

- Felten Property Assessment Team

- Client Reviews – Felten Property Assessment Team

- Structural Integrity Reserve Study – The Ultimate Guide

- Breaking Down Structural Integrity Reserve Study (SIRS) Terminology

- Condominiums and Cooperatives – SIRS Reporting

- Florida Structural Integrity Reserve Studies (SIRS)

Adapting To Change: Navigating Florida’s New Condo Laws With SIRS - Challenges With Florida’s New Condo Law