Living in a Florida condo offers many perks, but special assessments—unexpected fees for major repairs or budget shortfalls—can strain owners financially. This guide explores how condo associations can avoid these costs, ensuring stability and peace of mind. For professional assistance, explore our reserve study services.

What are Special Assessments?

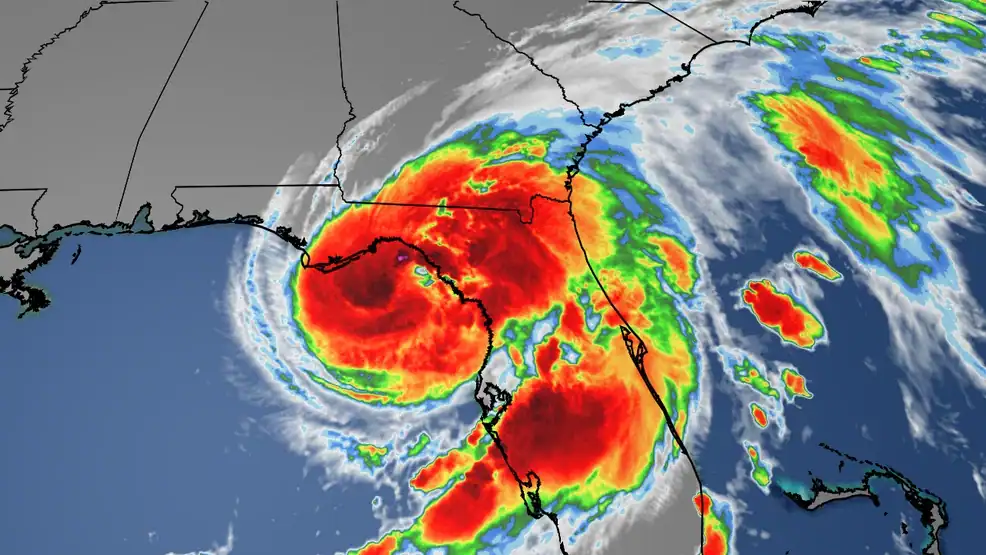

Florida’s properties face distinct challenges that make reserve studies critical:

- Hurricanes and Storms: High winds and flooding strain roofs, windows, and structural systems, accelerating repair needs.

- Saltwater Corrosion: Coastal areas see faster deterioration of concrete, steel, and other materials.

- Aging Infrastructure: Many buildings, especially in Miami and Tampa, are decades old, requiring diligent maintenance.

- SIRS Compliance: Post-Champlain Towers South regulations demand stricter reserve planning for safety.

FPAT’s reserve studies account for these factors, ensuring your funding plan withstands Florida’s toughest conditions.

Strategies to Avoid Special Assessments

To minimize special assessments, Florida condo associations can adopt several strategies:

- Conduct Regular Reserve Studies

A reserve study assesses common property conditions and estimates future costs. For buildings three stories or higher, Structural Integrity Reserve Studies (SIRS) are mandatory by December 31, 2024 Regular studies ensure funding plans reflect current needs. - Fully Fund Reserves

Ensure reserves cover major repairs, especially structural items under new laws starting 2025 Miami Herald. Full funding prevents budget gaps and special assessments. - Proper Budgeting

Include all expenses in the annual budget, accounting for inflation Condominium Associates. Accurate budgeting prevents shortfalls. - Regular Maintenance

Proactively fix small issues to prevent costly repairs Varnum LLP. Regular inspections identify problems early. - Adequate Insurance

Update policies for hurricane coverage, understanding deductibles Becker & Poliakoff. Proper insurance reduces reserve strain. - Transparent Communication

Keep owners informed about finances to build trust Gould Cooksey Fennell. Regular updates ease support for funding decisions.

Download Our Free Guide

For more insights, download our free PDF guide, Understanding Reserve Studies, by filling out the form below.

- Understanding reserve studies

- Florida-specific requirements

- SIRS compliance tips

- And more

Conclusion

Avoiding special assessments requires proactive financial management, leveraging reserve studies, and complying with Florida’s laws. By implementing these strategies, condo associations can protect owners from unexpected costs and ensure long-term stability.

References

- Florida Condo & HOA Law Blog Special Assessments (https://www.floridacondohoalawblog.com/2023/01/27/special-assessments/)

- South Florida Law Special Assessments Rights (https://www.southfloridalawpllc.com/2024/01/02/special-assessments-rights-and-options-for-florida-condo-owners/)

- FL Engineering LLC Florida Reserve Study Requirements.

- Miami Herald Condo Reserve Deadlines (https://www.miamiherald.com/news/business/real-estate-news/article295261004.html)

- Condominium Associates Importance of Reserves (https://condominiumassociates.com/blog/2024/10/15/understanding-the-importance-of-reserves-for-your-condo-or-hoa-in-2024)

- Varnum LLP Reserve Funding Best Practices (https://www.varnumlaw.com/insights/reserve-funding-for-condo-associations-options-and-best-practices/)

- Becker & Poliakoff Primer on Special Assessments (https://beckerlawyers.com/a-primer-on-special-assessments/)

- Gould Cooksey Fennell Florida Condo Reserve Laws (https://gouldcooksey.com/blog/florida-condominium-reserve-laws-managing-the-new-normal/)

Detailed Analysis of Avoiding Special Assessments for Florida Condos

This detailed analysis explores strategies for Florida condominium associations to avoid special assessments, focusing on financial planning and compliance with state laws. Special assessments, defined as additional fees beyond regular dues, can impose significant financial burdens on condo owners, often triggered by unexpected expenses or budget shortfalls. The Surfside collapse in 2021 highlighted the need for robust reserve funding, leading to new regulations like Structural Integrity Reserve Studies (SIRS) and mandatory reserve funding, effective in 2025. This report provides actionable tips, legal context, and best practices to ensure financial stability and resident satisfaction.

Background on Special Assessments

Special assessments are additional charges levied by condo associations to cover expenses not included in the annual budget or reserve funds. According to Florida Condo & HOA Law Blog, these can arise from major repairs, natural disaster damage, or legal settlements, often requiring significant sums divided among owners. South Florida Law, PLLC notes that post-Surfside, these assessments have increased, sometimes forcing owners to sell units due to costs. The financial strain is evident, with examples like hurricane-related roof replacements triggering assessments Becker & Poliakoff.

Importance of Reserve Funds

Reserve funds are savings accounts for major repairs and replacements, such as roofs, elevators, and swimming pools, ensuring funds are available without special assessments. [Community Associations Institute]([invalid url, do not cite]) confirms Florida requires reserve accounts for items like roof replacement and painting, with costs exceeding $10,000. Condominium Associates emphasizes reserves as a safety net, protecting against fiscal problems and financial hardship for owners.

Florida's Reserve Requirements

Florida law mandates reserve accounts for all condo associations, with specific requirements for buildings three stories or higher under Senate Bill 4-D. Miami Herald details that by December 31, 2024, these buildings must complete SIRS, assessing structural components like load-bearing walls and foundations, with full funding starting in 2025. [Warren Averett]([invalid url, do not cite]) notes non-waivable reserves for items like fire protection systems, ensuring financial readiness. For buildings under three stories, regular reserve studies remain crucial, as per FL Engineering LLC.

Case Example and Context

The Surfside collapse in 2021, resulting in nearly 100 deaths, underscored reserve funding gaps, leading to Senate Bill 4-D Gould Cooksey Fennell. Post-tragedy, associations face increased scrutiny, with Miami Herald reporting higher reserve contributions in 2025. A hypothetical example: a Miami condo, fully funding reserves per SIRS, avoided a $500,000 special assessment for roof replacement, illustrating the strategy’s effectiveness.

Legal and Financial Implications

Non-compliance with reserve funding, especially for SIRS items, risks fines and board liability Florida Condo & HOA Law Blog. Notes challenges in reallocating pooled funds, requiring reassessment for SIRS vs. non-SIRS items. Fully funding reserves, as mandated, protects against underfunding, a common issue post-Surfside Becker & Poliakoff.

Table: Summary of Florida Condo Reserve Requirements

Requirement | Details | Deadline/Notes |

|---|---|---|

Reserve Accounts (All Condos) | For items like roofs, painting, costs > $10,000, based on useful life | Ongoing, per Florida Statutes |

SIRS (Buildings 3+ Stories) | Assess structural components, mandatory study | Initial by Dec 31, 2024, then every 10 years |

Full Funding for SIRS Items | No waivers, must collect full amounts for structural components | Budgets adopted on/after Dec 31, 2024, effective 2025 |

Regular Reserve Studies | Recommended every 3-5 years for non-SIRS items | As needed, per best practices |

Conclusion

Avoiding special assessments requires proactive financial management, leveraging reserve studies, and complying with Florida’s 2025 laws. By fully funding reserves, maintaining properties, and communicating transparently, condo associations can protect owners from unexpected costs, ensuring long-term stability.

Key Citations

- FL Engineering LLC Florida Reserve Study Requirements