The Co-Insurance Trap: Why a Low Valuation is a Board’s Biggest Financial Risk

By the Felten Property Assessment Team | February 2026

In an era of skyrocketing insurance premiums, it is tempting for a Florida Condo or HOA Board to look for "wiggle room." Some Boards believe that by slightly under-reporting the replacement value of their buildings, they can lower their annual premiums and ease the budget.

This is known in the industry as The Co-Insurance Trap, and it is arguably the most dangerous financial gamble a Board can take.

What is a Co-Insurance Clause?

Most commercial property policies in Florida contain a Co-Insurance Clause (usually 80%, 90%, or 100%). This clause requires the Association to carry insurance equal to a specific percentage of the property's Actual Reconstruction Value.

If you fail to meet that percentage, the insurance company applies a "penalty" to every claim—even small ones. This makes having an accurate Florida insurance appraisal critical to your financial survival.

The Math: How the Penalty Works

If your building is valued at $10 Million but you only insure it for $8 Million (to save on premiums), you are 20% under-insured. If a storm causes $100,000 in roof damage, the carrier will not pay the full $100,000. Underwriters today often require an itemized appraisal award to verify these percentages are met.

The formula the adjuster uses is:

(Amount of Insurance Carried ÷ Amount of Insurance Required) x Amount of Loss = Your Payout

| Scenario | Value | Calculation | Final Payout |

|---|---|---|---|

| Actual Value | $10,000,000 | — | — |

| What You Insured | $8,000,000 | (8M / 10M) = 80% | — |

| Your Claim | $100,000 | 80% of $100k | $80,000 |

In this scenario, the Association is forced to "co-insure" the remaining $20,000 out of pocket. For a multi-million dollar hurricane claim, this "gap" can lead to massive Special Assessments that infuriate residents.

3 Reasons Why This is a "Nightmare" for Florida Boards

1. It Applies to Partial Losses

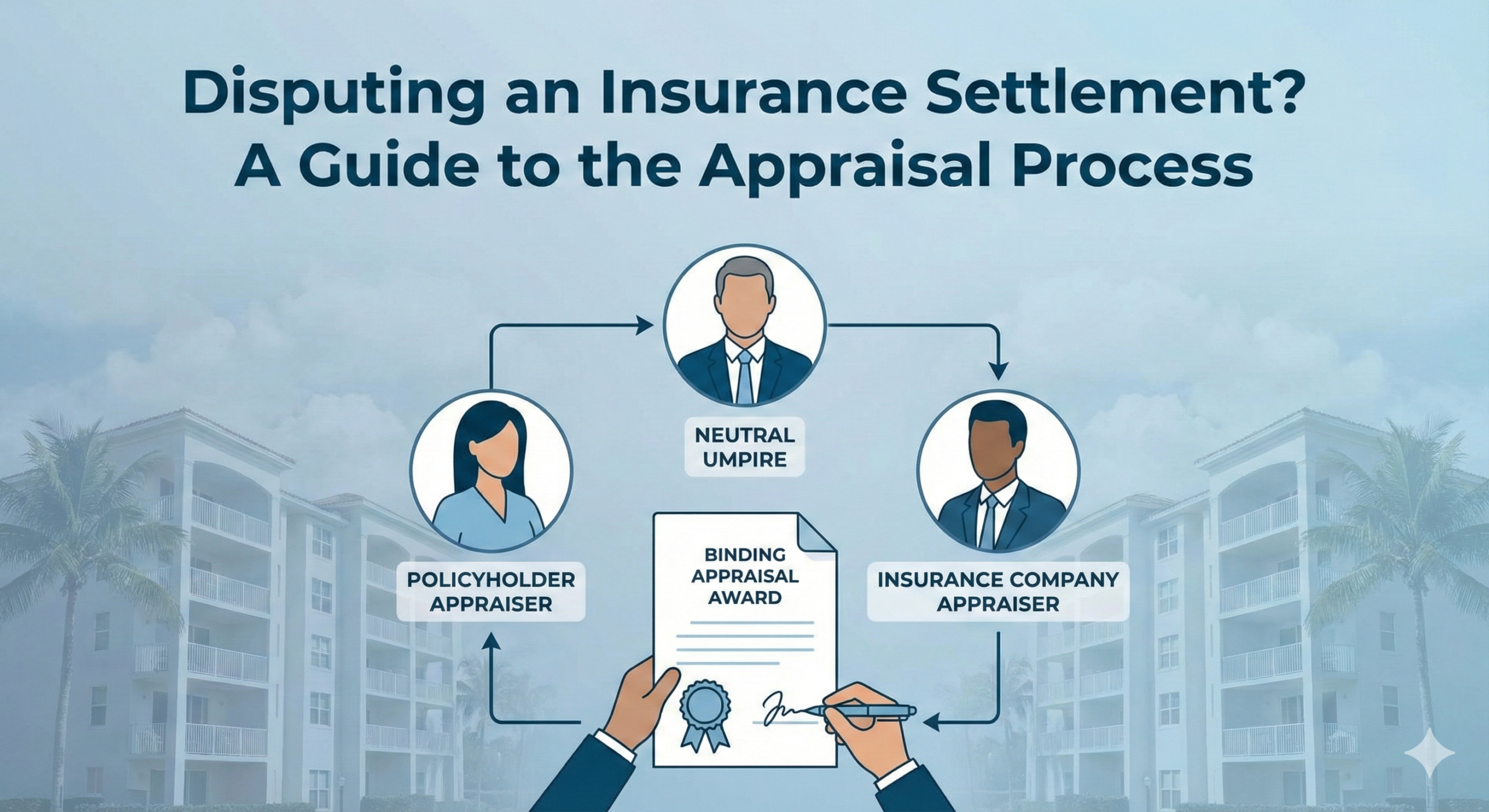

Many Board members mistakenly think, "We only need enough to cover a partial loss; we’ll never lose the whole building." The Co-Insurance penalty applies to every single claim, regardless of size. If you are currently in a dispute over a settlement, understanding the insurance appraisal process is the first step toward recovery.

2. Breach of Fiduciary Duty

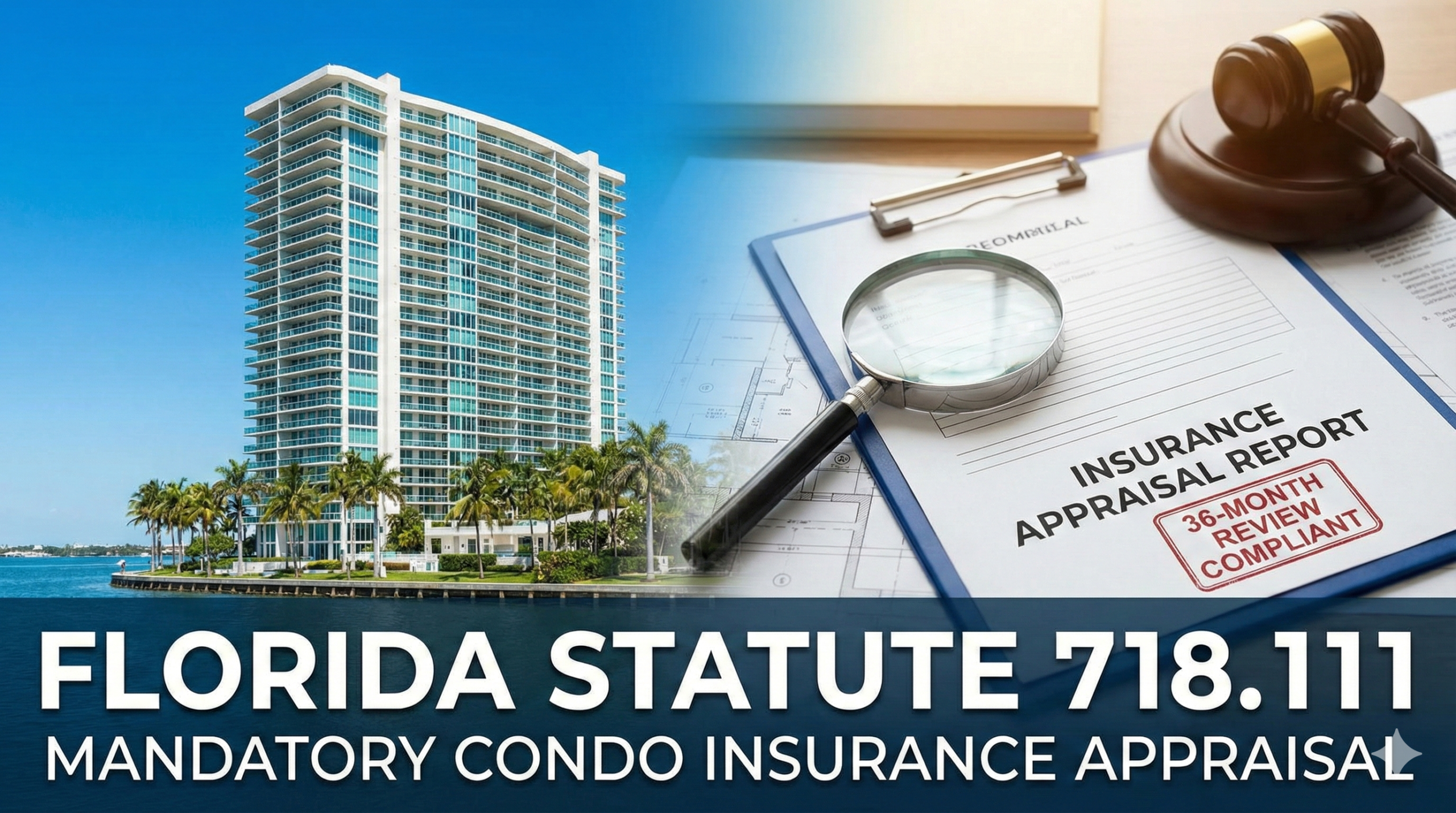

Florida Statutes (Chapter 718 for Condos and 720 for HOAs) require Boards to exercise "best efforts" to obtain full replacement cost coverage. Intentionally under-insuring the property to save on the budget is a direct violation of Florida Statute 718.111(11). If a gap in coverage leads to a special assessment, unit owners can sue the Board members personally for negligence.

3. The "2026 Inflation Surge"

With reconstruction costs in Florida rising by double digits, a valuation that was "accurate" two years ago is likely under-insured today. Underwriters are also scrutinizing structural health—failing to keep up with your Structural Integrity Reserve Study (SIRS) can lead to even stricter policy terms.

How to Avoid the Trap

The only way to "bulletproof" your Association against a co-insurance penalty is to have a USPAP-compliant Reconstruction Cost Valuation.

- Don't Guess: Market value has nothing to do with reconstruction cost. Learn more in our insurance appraisal glossary.

- Update Every 36 Months: This is a statutory requirement for Florida Condos to maintain 718.111 compliance.

- Use Reconstruction Data: Ensure your appraiser uses insurance-specific tools like Marshall & Swift, not standard local contractor quotes.

Don’t Gamble with Your Association’s Future

Saving 10% on your premium by under-valuing your property is a "win" that lasts until the first storm. Let FPAT provide a defensible, accurate appraisal that satisfies carriers and protects your Board.

Get a Free Appraisal Proposal NowOr call us at 866-568-7853