Disputing an Insurance Settlement? A Guide to the Appraisal Process

Understanding the Appraisal Clause for Florida Condo & HOA Boards

When a Florida Association receives a settlement offer after a hurricane or major loss that doesn't cover the true cost of repairs, the Board often feels stuck. However, most commercial policies contain a specific provision called the Appraisal Clause. This is a powerful alternative dispute resolution tool designed to resolve disagreements over the "amount of loss" without the need for costly litigation.

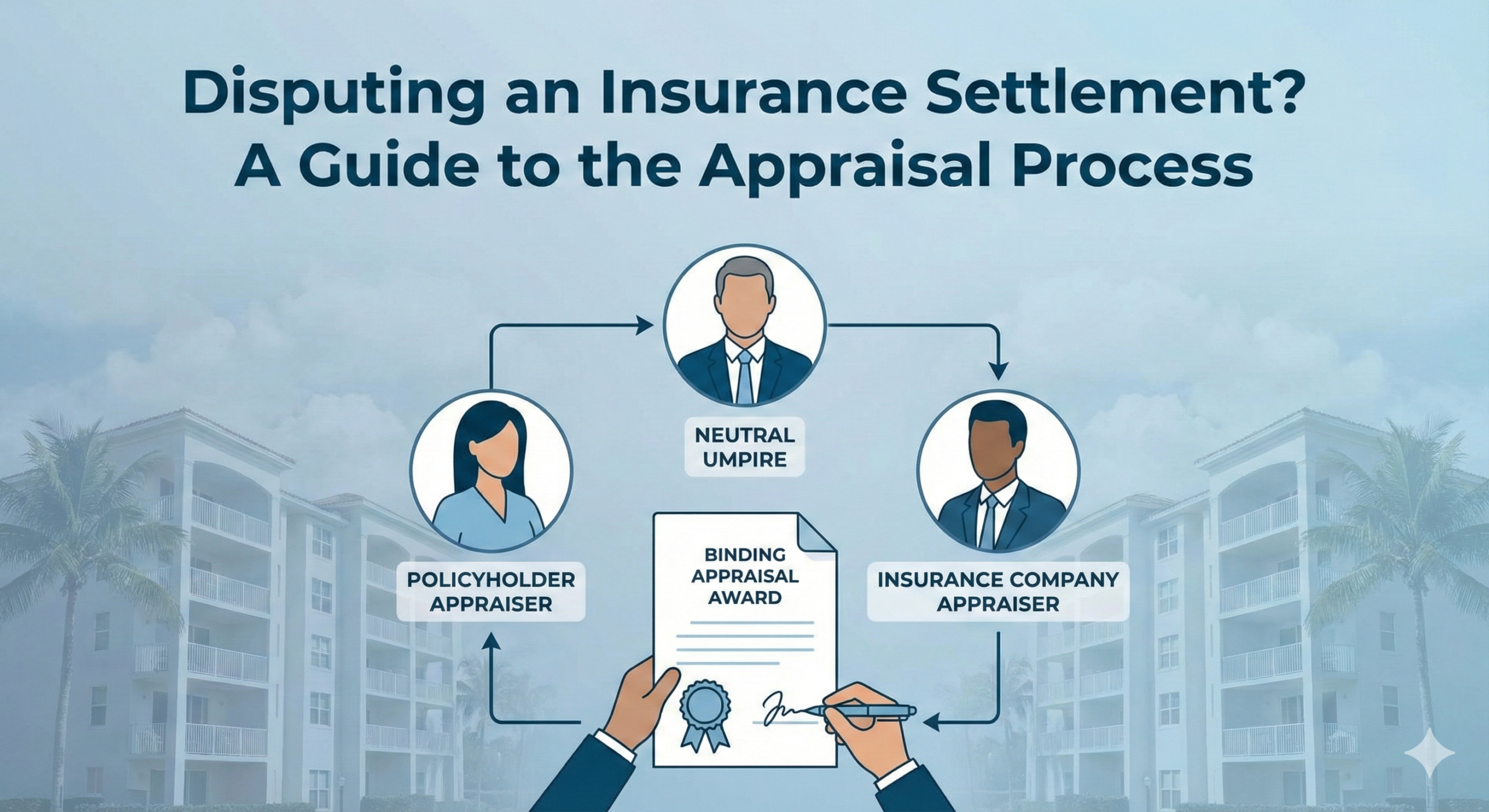

How Does the Insurance Appraisal Process Work?

The process is typically triggered when there is a clear disagreement on the price tag of the damage. Here is the standard 4-step workflow:

- Invoking the Clause: Either the Association or the carrier sends a formal written demand for appraisal.

- Selection of Appraisers: Each party selects an independent, competent appraiser. At this stage, many Boards choose FPAT for our reconstruction expertise.

- Umpire Selection: The two appraisers select a neutral "Umpire" to act as the tie-breaker if they cannot agree.

- The Appraisal Award: The appraisers (and Umpire, if necessary) review the damage. Once any two of the three parties agree on a value, they sign an "Appraisal Award," which sets the final amount of the loss.

Is an Insurance Appraisal Binding?

Yes. In Florida, once an appraisal award is signed by two of the three participants, it is generally binding as to the amount of the loss. It is very difficult to overturn an award in court unless there was evidence of fraud or a major procedural error. This is why selecting a highly qualified appraiser who understands statutory reconstruction requirements is critical.

When to Invoke the Appraisal Clause?

You should consider invoking appraisal when:

- The carrier has admitted coverage but provided a "lowball" estimate.

- Negotiations between your public adjuster and the carrier’s adjuster have stalled.

- You want to avoid the 2-3 year delay and high costs associated with an insurance lawsuit.

Note: Appraisal is for disputes over scope and price, not for disputes over whether a claim is covered or denied entirely.

The Cost of Insurance Appraisal

Per standard policy language, each party pays for their own selected appraiser and splits the cost of the neutral Umpire. While there is an upfront cost, the resulting increase in the settlement amount often far outweighs the professional fees, making it a sound financial decision for the Association's budget.

Disputing a Low Settlement?

Don't leave your community's recovery to chance. Let FPAT serve as your expert appraiser to ensure your "Amount of Loss" reflects the true 2026 reconstruction costs.

Get an Appraisal ConsultationProfessional dispute resolution for Florida Condos and HOAs.