Statutory Insurance Appraisals: Navigating the 36-Month Rule

A Board Member's Guide to Florida Statute 718.111(11) Compliance

For Florida Condominium Associations, an insurance appraisal isn't just a best practice—it is a legal mandate. Under Florida Statute 718.111(11), associations are required to update their replacement cost valuations at least once every 36 months. Failing to meet this "36-Month Rule" exposes the Board to significant legal risks and potential insurance denials.

The Risk of Non-Compliance

In the 2026 insurance market, carriers are strictly enforcing the 36-month condo appraisal requirement. If your last Florida insurance appraisal is dated more than three years ago, you may face:

- Immediate policy non-renewal or cancellation.

- Claims of breach of fiduciary duty against individual Board members.

- Proportional payout reductions due to under-insurance.

What Does the Law Specifically Require?

The statute dictates that the Association must provide "adequate property insurance" based on the Full Replacement Cost of the property. The only way to legally determine this value is through an independent, professional appraisal.

According to the official Florida Senate text for Chapter 718, the replacement cost must be determined at least every 36 months. This ensures that as construction costs rise across the state, your coverage keeps pace.

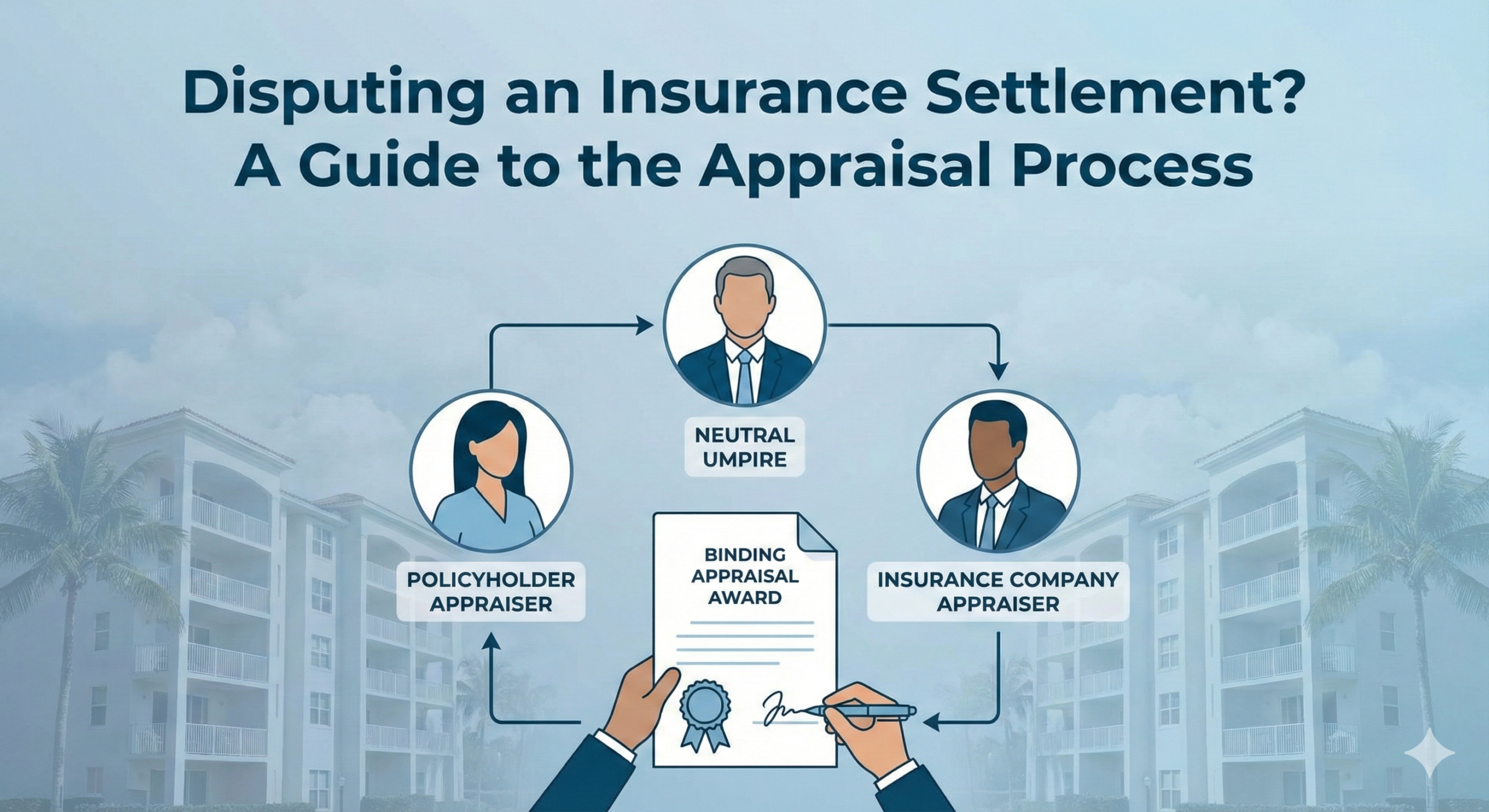

"Best Efforts" and Board Liability

The law requires Boards to use their "best efforts" to obtain the required coverage. If a catastrophic event occurs and the building is under-insured because the Board relied on an outdated or "market-value" report, the Board can be held personally liable for the financial shortfall. A Statutory Insurance Appraisal from a qualified firm like FPAT provides the "safe harbor" protection your Board needs.

Ensuring Compliance in 2026

Updating your valuation is only half the battle. To truly satisfy co-insurance requirements and avoid penalties, your report must use professional databases like CoreLogic/Marshall & Swift. A standard contractor's estimate will not hold up during a carrier audit or a legal challenge.

Is Your 36-Month Clock Ticking?

Don't wait for your insurance agent to flag your outdated appraisal. Get a USPAP-compliant Statutory Insurance Appraisal that guarantees Chapter 718 compliance and protects your Board.

Request a Compliance ProposalSecure your Association's future today.