HOA Insurance Appraisals: Navigating Florida Chapter 720

Understanding Valuation Requirements for Florida Homeowners’ Associations

While Florida Statute 718.111 provides a very specific "36-month clock" for Condominiums, the rules for Homeowners’ Associations under Florida Statute Chapter 720 are often viewed as more flexible. However, this flexibility can be a trap for unsuspecting Boards. Despite the lack of a specific timeframe in the statute, the fiduciary duty to maintain "adequate insurance" remains a legal mandate.

The Chapter 720 Duty to Insure

Under Chapter 720, the Association is generally responsible for insuring all common areas and any structures mandated by the governing documents. This often includes clubhouses, gatehouses, perimeter walls, and specialized amenities. The law requires Boards to use "best efforts" to obtain coverage that protects the Association’s assets.

With reconstruction costs in Florida rising significantly, an HOA relying on a valuation from five years ago is almost certainly under-insured. If a catastrophic event occurs, the Board can be held liable for the shortfall between the insurance payout and the actual cost to rebuild. Many Boards ask, is an insurance appraisal worth it? In the context of Board liability, the ROI is undeniable.

Market Value vs. Replacement Cost: The HOA Myth

A common mistake for HOA Boards is relying on a Market Value Appraisal rather than a Replacement Cost Valuation (RCV). In an insurance claim, the carrier does not care about the real estate market; they only care about the cost of labor and materials in today’s economy.

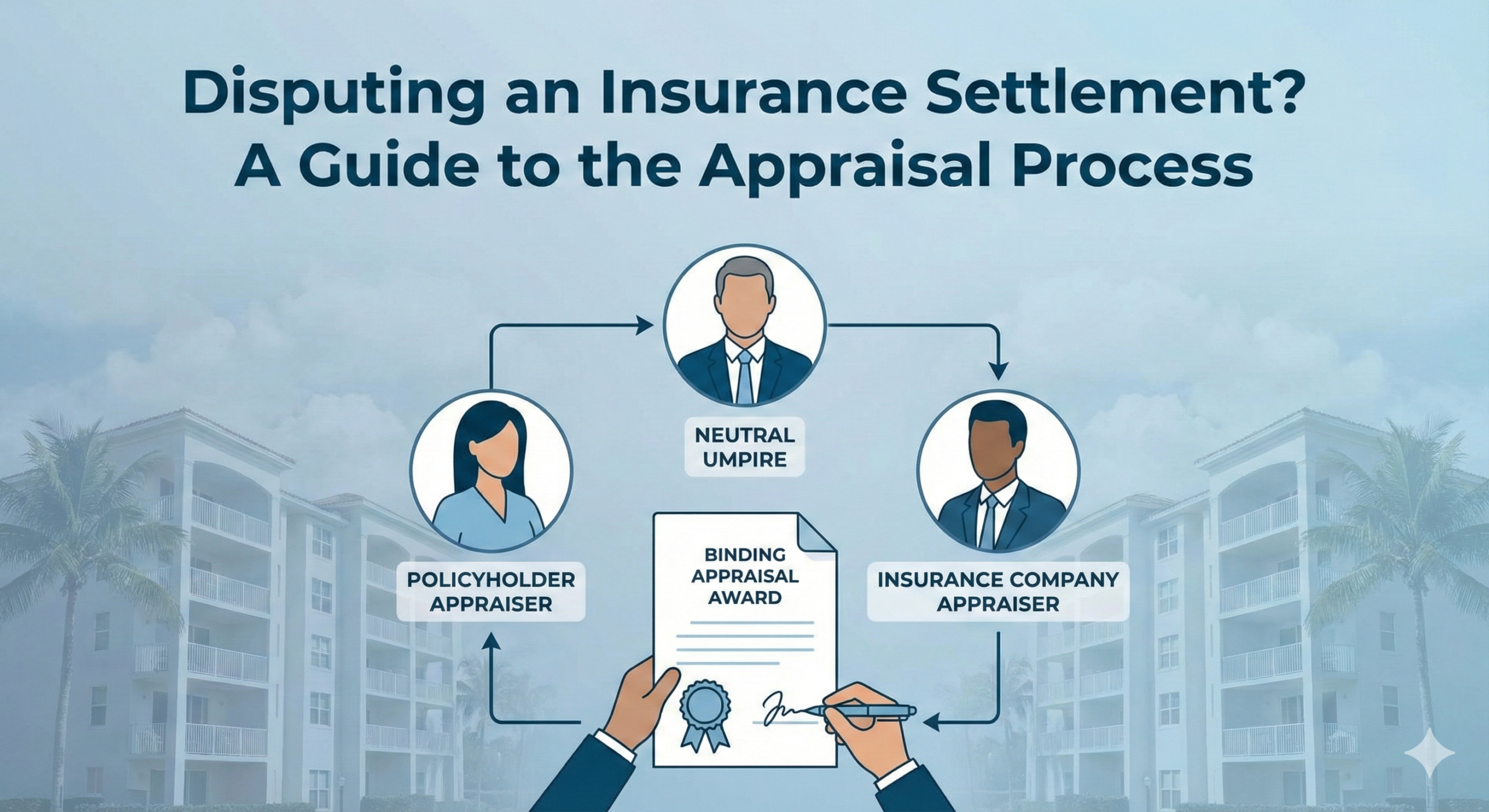

A professional Florida HOA Insurance Appraisal ensures that your common elements are covered at their true reconstruction price, helping you avoid the co-insurance trap. If you find yourself in a dispute with your carrier over these values, understanding the insurance appraisal process is vital for a fair recovery.

Why HOAs Still Need the "36-Month Rule"

Even though Chapter 720 doesn't explicitly name a 36-month requirement like its Chapter 718 counterpart, most insurance carriers now require it as a condition of the policy. To maintain "Preferred Risk" status and keep premiums manageable, your HOA should treat the 36-month update as a best practice to ensure statutory compliance and fiduciary safety.

Is Your HOA Fully Protected?

Don't leave your common area assets to guesswork. Get a professional Chapter 720 compliant appraisal that protects your Board and your community's reserves.

Request an HOA ProposalSpecialized Valuation Services for Florida Homeowners' Associations.