Is an Insurance Appraisal Worth It for Florida Associations?

Evaluating the ROI of Professional Property Valuations in 2026

Is an insurance appraisal worth it?

Yes. An insurance appraisal is worth it because it ensures your property is accurately valued to replacement cost, protecting you from massive out-of-pocket losses. In Florida, it is also a legal requirement for condos to prevent co-insurance penalties and satisfy fiduciary duties, often paying for itself by qualifying the association for lower premiums and preferred carrier status.

While some homeowners may view an appraisal as an optional expense, for Florida Condo and HOA Boards, it is a critical financial safeguard. With construction costs in Florida rising by 10-20% recently, relying on outdated estimates is a gamble that rarely pays off.

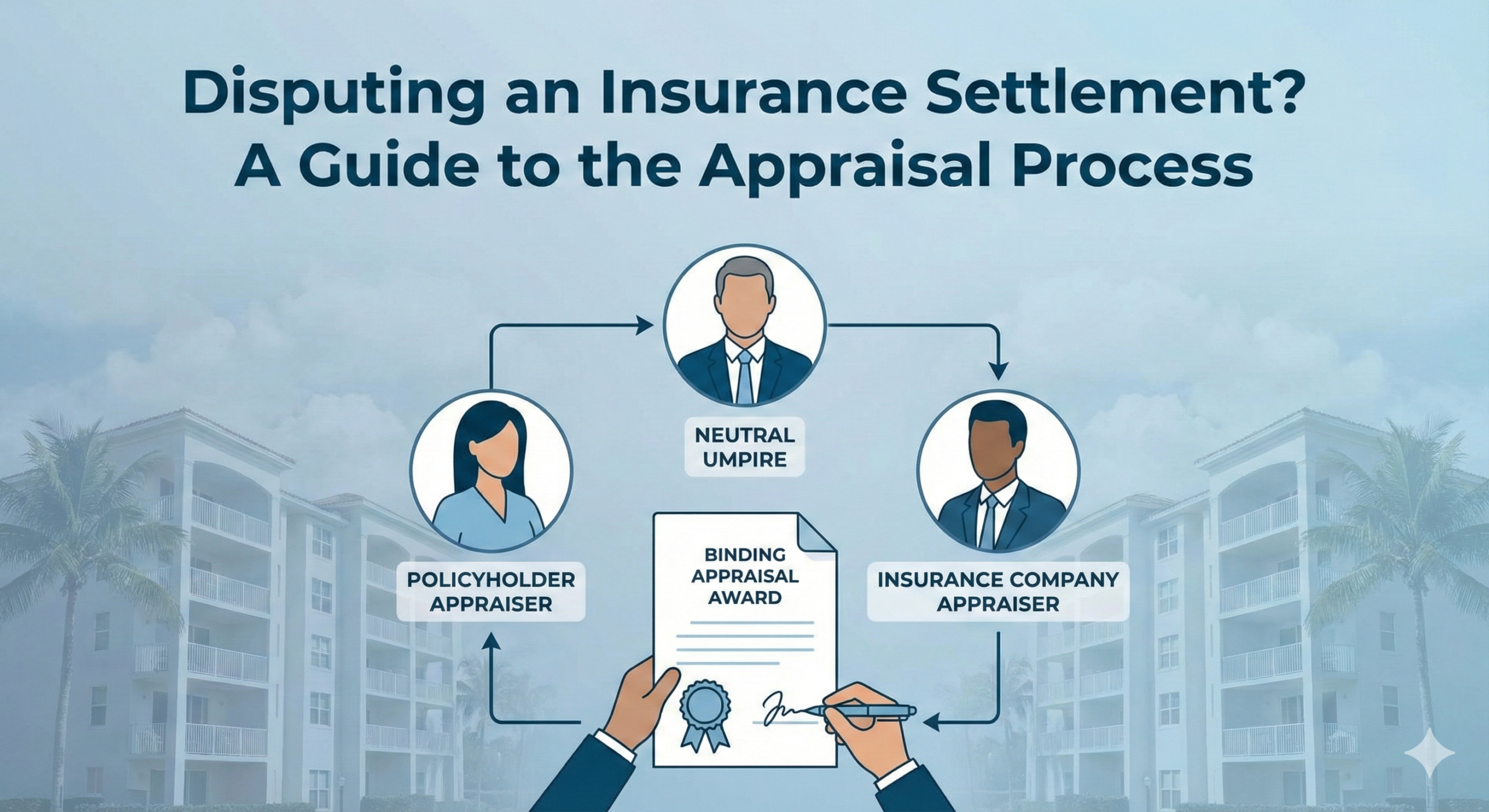

3 Ways an Insurance Appraisal Pays for Itself

If you under-insure to save 10% on premiums, the carrier can slash your claim payout proportionally. An accurate appraisal prevents this "penalty" from draining your reserves during a storm.

Under Florida Statute 718.111(11), updating your appraisal every 36 months is mandatory. This protects Board members from personal liability and lawsuits for "breach of fiduciary duty."

Carriers view associations with current, USPAP-compliant appraisals as "Preferred Risks." This data-driven transparency often leads to better terms and lower annual increases compared to "guessed" valuations.

Don't Guess Your Community's Value

The cost of an appraisal is a fraction of the risk of being under-insured. Get a defensible report from FPAT today.

Get a Free Proposal in 24 Hours