Technical Terms in Association Insurance & Appraisal

A Professional’s Glossary for Florida Chapter 718 & 720 Compliance

In the complex world of Florida property insurance, the difference between a full recovery and a major budget shortfall often comes down to a few technical definitions. For Board members and Property Managers, understanding these "niche" terms is vital when reviewing a Statutory Insurance Appraisal or navigating a claim dispute.

1. Actual Cash Value (ACV) vs. Replacement Cost Value (RCV)

This is the most critical distinction in any policy. Replacement Cost Value (RCV) is the "sticker price" to rebuild your community today with materials of like kind and quality, without deducting for age or wear. Actual Cash Value (ACV) is the RCV minus depreciation.

Under Florida Statute 718.111(11), Condo Associations are generally required to insure based on Full Replacement Cost. If your policy is settled on ACV, the Association will likely face a massive "funding gap" during a major loss.

2. Demand for Appraisal Letter

This is the formal legal document that "invokes" the appraisal process. When a Board decides to dispute a low carrier offer, they must send an itemized Demand for Appraisal. This letter must identify the specific policy provision being used and name the Association’s chosen competent, independent appraiser.

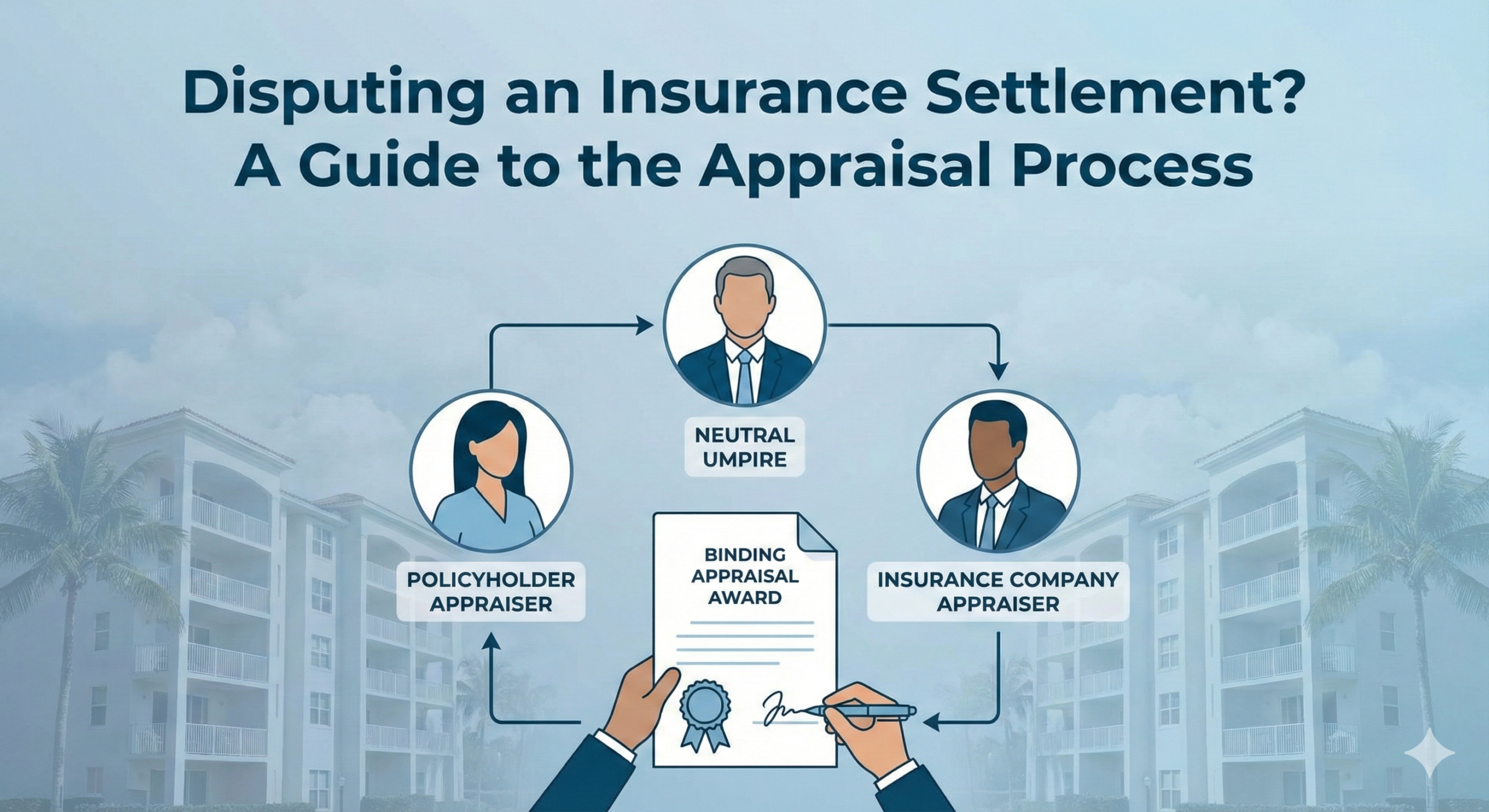

3. Appraisal Umpire Selection

If the two appointed appraisers cannot agree on the "Amount of Loss," they must select a neutral Umpire. The Umpire acts as the final arbiter. A quality appraisal award is typically signed by the Umpire and at least one of the two appraisers.

4. Causation vs. Scope in Appraisal

It is important to know that in Florida, the appraisal process is designed to determine the Scope (what needs fixing) and the Price (how much it costs). It is not designed to determine Causation (whether the damage was caused by a hurricane vs. wear and tear). If the carrier denies the claim entirely based on causation, the Board may need legal counsel rather than an appraiser.

5. Itemized Appraisal Award

Underwriters and carriers in 2026 increasingly require an Itemized Appraisal Award. Rather than a single "lump sum" number, this award breaks down costs by building, roof, interior finishes, and specific common elements. This transparency is vital for avoiding the co-insurance trap.

Confused by Policy Language?

Don't let technical jargon prevent your Association from receiving a fair settlement. FPAT provides the expert reconstruction data required to win technical disputes.

Request Technical ConsultationSpecialists in Florida Reconstruction Valuations & Dispute Support.