HOA Insurance Appraisals | Chapter 720 Compliance Guide

Talk to an Expert 866.568.7853 HOA Insurance Appraisals: Navigating Florida Chapter 720 Understanding Valuation Requirements for Florida Homeowners’ Associations While Florida Statute 718.111 provides a very specific “36-month clock” for Condominiums, the rules for Homeowners’ Associations under Florida Statute Chapter 720 are often viewed as more flexible. However, this flexibility can be a trap for […]

Insurance Appraisal Worth It?

Talk to an Expert 866.568.7853 Is an Insurance Appraisal Worth It for Florida Associations? Evaluating the ROI of Professional Property Valuations in 2026 Is an insurance appraisal worth it? Yes. An insurance appraisal is worth it because it ensures your property is accurately valued to replacement cost, protecting you from massive out-of-pocket losses. In Florida, […]

ACV vs RCV & Insurance Appraisal Terms

Talk to an Expert 866.568.7853 Technical Terms in Association Insurance & Appraisal A Professional’s Glossary for Florida Chapter 718 & 720 Compliance In the complex world of Florida property insurance, the difference between a full recovery and a major budget shortfall often comes down to a few technical definitions. For Board members and Property Managers, […]

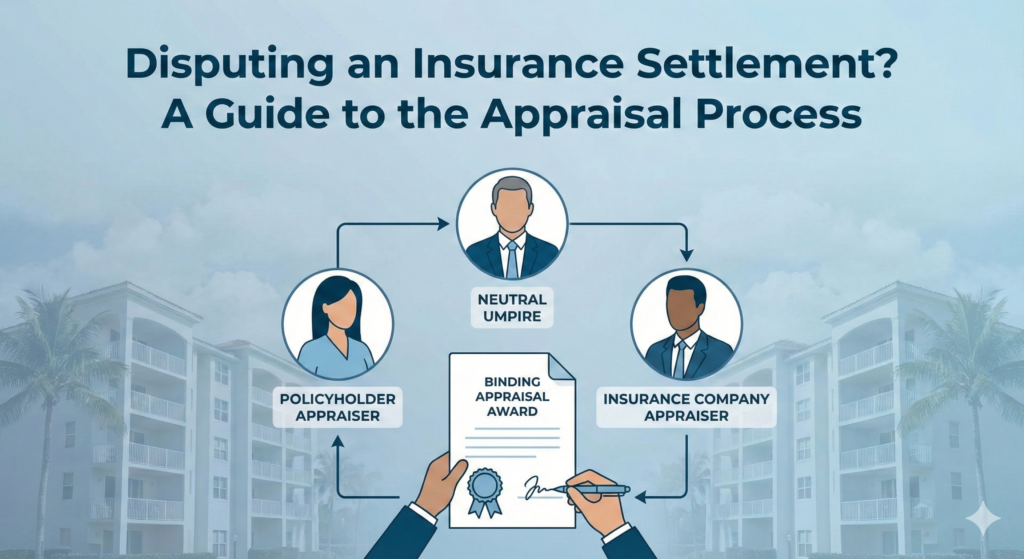

How the Insurance Appraisal Process

Talk to an Expert 866.568.7853 Disputing an Insurance Settlement? A Guide to the Appraisal Process Understanding the Appraisal Clause for Florida Condo & HOA Boards When a Florida Association receives a settlement offer after a hurricane or major loss that doesn’t cover the true cost of repairs, the Board often feels stuck. However, most commercial […]

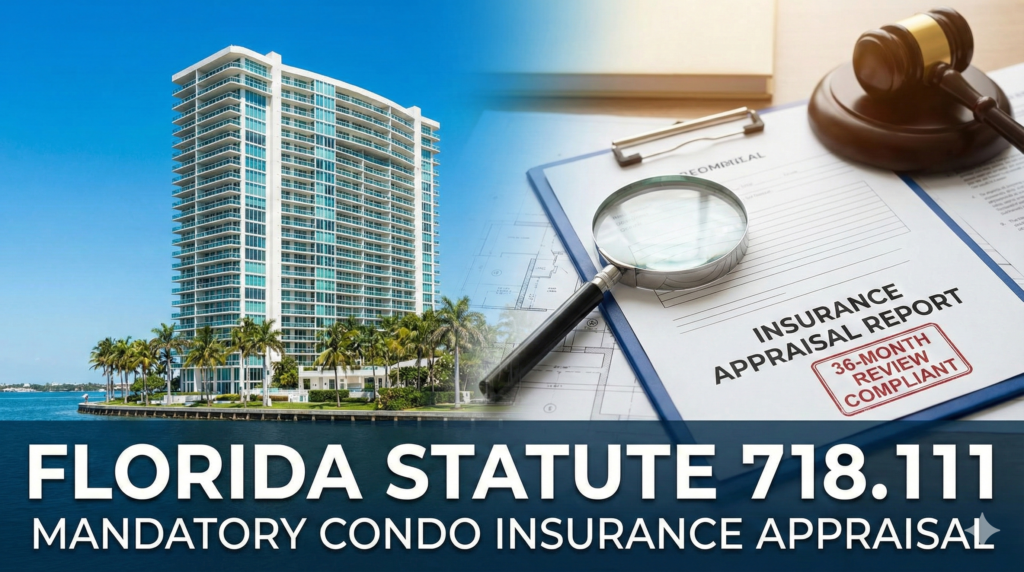

Florida Statute 718.111

Talk to an Expert 866.568.7853 Statutory Insurance Appraisals: Navigating the 36-Month Rule A Board Member’s Guide to Florida Statute 718.111(11) Compliance For Florida Condominium Associations, an insurance appraisal isn’t just a best practice—it is a legal mandate. Under Florida Statute 718.111(11), associations are required to update their replacement cost valuations at least once every 36 […]

The Co-Insurance Trap

Talk to an Expert 866.568.7853 The Co-Insurance Trap: Why a Low Valuation is a Board’s Biggest Financial Risk By the Felten Property Assessment Team | February 2026 In an era of skyrocketing insurance premiums, it is tempting for a Florida Condo or HOA Board to look for “wiggle room.” Some Boards believe that by slightly […]